By this point in the pandemic timeline, every business that advertises online has had to make a series of decisions about their digital advertising programs. Should they keep their programs on? If so, which tactics and how much money should they spend? Does their messaging need to change? Will it seem self-serving or artificial to their audiences if they do? Will it turn their audiences off if they don’t?

Now more than ever, it’s important for advertisers to understand exactly who they are and what they mean to their target audiences. This notion—of understanding exactly why customers choose a brand and how they feel about it—is the key to successfully answering any of the questions above.

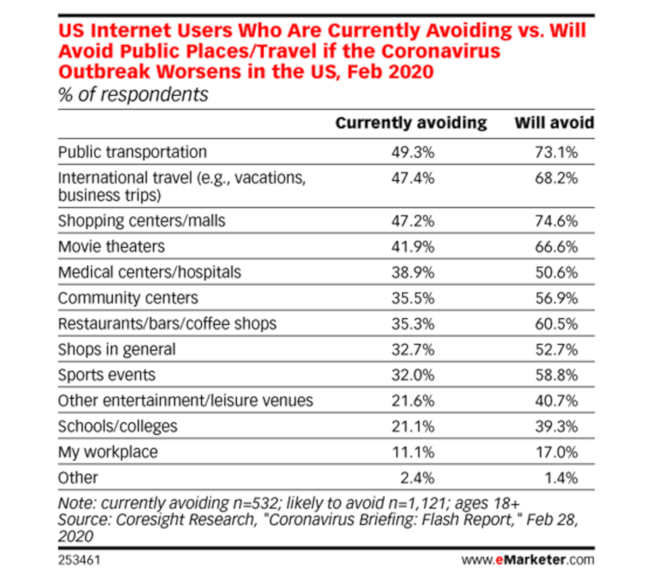

We know that as early as February users were already shifting their behaviours, planning to stay away from public places and shifting those behaviours online, where an online option was available:

So does that mean advertisers should stay online? As businesses struggle to keep the lights on even as their doors are closed, we do know that there is a great desire for normalcy amongst those people stuck at home—as our very own Nasser Sahlool wrote here. For many people who are fortunate enough to remain employed in a work-from-home capacity, online shopping may be one way people can maintain that sense of normalcy they crave.

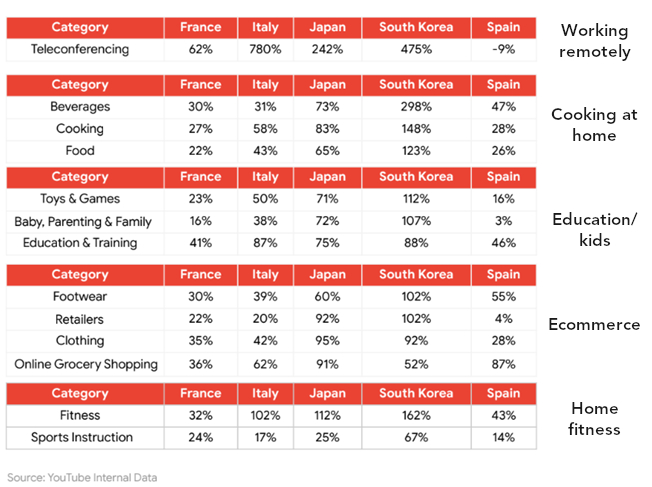

Online shopping solves a boredom problem, sure, but it may also serve a larger purpose: reminding us that many aspects of life continue unabated. New outfits remind us that spring is here (technically, anyway!). Toys and training products for our pets allow us to make the extra time we have with our furry friends more enriching. Online education services allow us to continue to learn and grow, even without a physical classroom. And new fitness classes that can be done digitally (and even in real time) allow us to stay fit and healthy. Indeed, online shopping demand is up significantly in most categories—not just grocery—based on search query volume (March 2019 vs. March 2020 YouTube data):

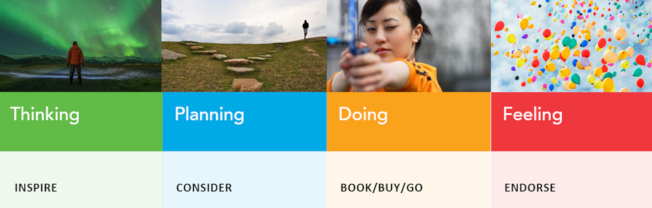

Indeed, as of March, 80% of US consumers said that even if the outbreak gets worse, they’ll continue to spend as normal. However, each brand needs to decide for themselves what the right approach is for themselves and their customers. At DAC, we believe that if advertisers approach their crisis decision-making from the vantage point of their customer(s), they’ll have all the answers they need on how to navigate their digital ad spending and messaging in the coming weeks. We deploy a strategic framework for our clients that’s based on the intent of their customers at every stage of the decision journey:

In addition to this customer-centric view of planning, we also look to data-led personas and user journeys as tools that can effectively pinpoint what a brand’s customers need, want, and expect from them at each stage of their buying journey. These types of tools are essentials in today’s rapidly changing response to the pandemic, as they allow a brand to remain focused on their customers and deliver the right message to them, with the right channel and tactic mix.

Vera Bradley, an American fashion retailer with both brick-and-mortar and ecommerce buying options, is one business that has realised the potential of their brand promise during this time. With messaging on their website that speaks to the closing of their stores, they hone in on what they, as a brand, have always believed: that “we are better together” and “there is beauty to be found in every day”. They also reference that they’re working to outfit their manufacturing to create face masks for health care workers, and scrubs are now also available and linked prominently on their homepage.

We’re in (mostly) uncharted territory

Tactically, then, how should a brand approach their digital spend? How should they know where to focus their marketing efforts and dollars when there is no historical basis to compare to when planning in this “new normal”? Digital marketers are going to have to put their skills to the test by deploying a nimble leave-no-stone-unturned mentality to more closely determine the appropriate strategies, tactics, and budget allocations to make a lasting impact in their programs.

While every industry may be impacted differently by COVID-19—from retail to consumer packaged goods to hotels and travel—one thing is for sure: benchmarks and historical baselines will become less relevant in media forecasting and decision making.

What happened in January of 2020 or the same time last year is no longer indicative of what will happen now or in the next few months. While annual events like Black Friday may continue to indicate trending to some capacity, consumer behaviour has and will continue to shift and evolve as our routines, finances, and seasonal behaviours are disrupted. That being said, if advertisers are fortunate enough to have a robust historical data set dating back to the mid-to-late 2000s (or prior case studies), there could be some valuable trending consistent with economic recessions, natural disasters, and more.

The pandemic in and of itself will become the “new” baseline and benchmark for success versus prior measurement tactics comparing year-over-year KPIs and sales. Comparing week to week and month to month will become the best indicator of program success. Long gone are the days of yearly and weekly budget flighting exercises, as fluidity amongst weeks and months and channels alike will be crucial to acting against real-time trends.

Is reactivity the new proactivity?

We pride ourselves on maintaining a proactive mentality to optimising our programs and providing strategic recommendations to our clients. The way in which we view proactivity in our “new normal” will help shape the art of digital marketing—for the foreseeable future, at the very least.

While this may sound contradictory, the key to being proactive in the current landscape is to be reactive. Reactivity will become the new proactive measure that advertisers need to embrace in order to successfully plan and execute their media programs.

What does this mean exactly? We as advertisers, brands, and consumers can no longer predict what the future holds for us. We can only monitor what is happening in the here and now to determine the best next step forward. What happens today may greatly shift tomorrow and into the following weeks. It may vary by category, region, competitive saturation, economic factors, and more—all at a more rapid pace than we have ever seen before. A broad perspective for your activations will no longer work because it simply isn’t s one-size-fits-all model.

It will take dedication and significant analysis, monitoring, and communications with clients to marry the trending of the landscape, program performance, and business data to successfully execute. Marketers can do their due diligence to drive “proactive reactive” recommendations by exploring numerous avenues on daily/weekly basis:

-

Demand/trend reports

This will easily be one of if not the most important report/tool to leverage during this time. Reviewing demand data from Google around subsets of queries and reports (like Google Trends) will allow advertisers to make real-time determinations of what’s happening in the market—and whether these trends are industry wide or specific to your brand. If you’re lucky enough to have a Google rep, ask for a demand report to tailor to your specific needs and hone in on the most relevant categories/topics/locations to your brand for more accuracy.

-

Competitive reports and tools

Not only is it imperative to look at top level trending for your brand and non-branded queries, but having consideration of competitive behaviours through tools like SEMrush and Moat, SEM auction insights, organic rankings, ad depth reports, various industry reports, and platform and SERP landscape audits. This will help advertisers to cross-reference demand trends in the industry to the behaviours of their competitors to ultimately determine if competitive activity is contributing to the larger landscape trending and when and how they may want to act upon it.

-

Geographic/categorical behaviours

Tactically speaking, geographical and categorical behaviours need to be reviewed in every capacity as they will uncover trends that will shape media allocation and activation at the most granular level. For instance, an auto service client may deploy one overarching media budget, but an advertiser may witness trending differences between that of an “oil change” consumer and a “battery replacement” consumer. That, coupled with regional trends specific to government lockdowns and the slow return of business, will allow advertisers to make strategic decisions around what category allocations should look like within a given budget and if a regionally focused activation would be more efficient than national.

-

Website/offers

As unemployment is on the rise and price sensitivity becomes the norm, how brands are messaging price, offers, and financing options—and the tone in which they do so—could be the deciding factor between making a sale or not. Scouring competitor sites and ads for how they approach promotions, the types of offers in market, and the tone of voice is key to understanding your brand’s opportunity to go head to head with these competitors.

Putting it all into action

Let’s get practical. Here’s how a marketer could use these tools and reports to determine a plan of action just with a week or two of new data.

Client X, in the wake of the pandemic, decided to pull funding across marketing channels, pausing all upper funnel efforts and maintaining a lower presence in paid search to be there for the consumers that are still actively searching for the brand and their products and services.

We monitored trending for their brand as well as their non-branded category on a weekly basis both through Google Demand trend reports and the performance trending within the program (eligible impressions, impression share loss due to budget, auction insights, ad depth).

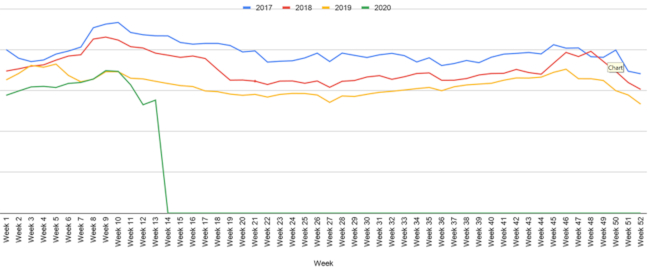

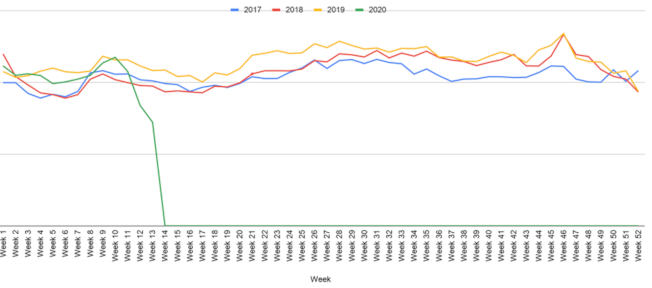

The graph above showcases the demand trends for the advertiser’s category. On the whole, while the category had seen lower demand than years past for some time, the category saw a greater decline over the first few weeks of the pandemic, but experienced a slight uptick in week 13. Digging into this on a regional/state level, it was uncovered this was consistent across locations—so there was no need to activate differently for locations in this category.

The slight uptick in the category overall, however, could imply that if Client X is not the one creating the uptick in demand through upper funnel, another competitor is. This is where exploring third-party tools and platform reviews come into play. We uncovered that competitors continued to run awareness efforts while Client X pulled away. In conjunction with this, running an organic report also indicated that these competitors had strong organic presence and ranking, showcasing an opportunity for the client to focus efforts organically to help offset gaps—something paid search cannot do alone.

Next, we reviewed branded trending for Client X. Prior to the pandemic, we implemented significant awareness efforts to build the brand, as validated by the increased demand shown above. As the client pulled out of these efforts, you can see that branded demand took a significant drop. This sparked the recommendation that re-entering the market with an awareness play may not only help build affinity for the brand back up, but correlative declining eligible impressions in paid search would benefit from these efforts in order to drive greater conversion.

Nielsen states that at-home entertainment consumption of streamed content has increased 60%, while Google Trends reports a surge in YouTube queries, suggesting that upper-funnel channels are where consumers are spending most of their time right now—a perfect opportunity to get back into these channels. Because regional and local behaviours and situations may vary, it is imperative to review opportunity and activation on a market-by-market basis to remain efficient, especially now that advertisers are more circumspect than ever about the dollars they put back into market.

Written by Jenna Watson, VP, Digital Media and Felicia DelVeccio, Director, Digital Media