DAC and Kantar are proud to release the results of their latest consumer search behaviour survey. In its fifth year, the comprehensive study uncovers trends and improves the understanding of consumer media usage in Canada and the US. Results in the categories of general consumer search behaviour, mobile, and social search show steady trending in digital adoption. Slight variances in findings uncover unique needs highlighted in select sectors. Overall insights gleaned reinforce the need for today’s Digital CMO to take a strategic look at online consumer conversion strategy. Below we share some of the highlights gleaned in consumer online behaviour.

Key DAC/Kantar Findings (US):

- Consumers continue to show greater confidence in “organic search” results overpaid (61% versus 17%)

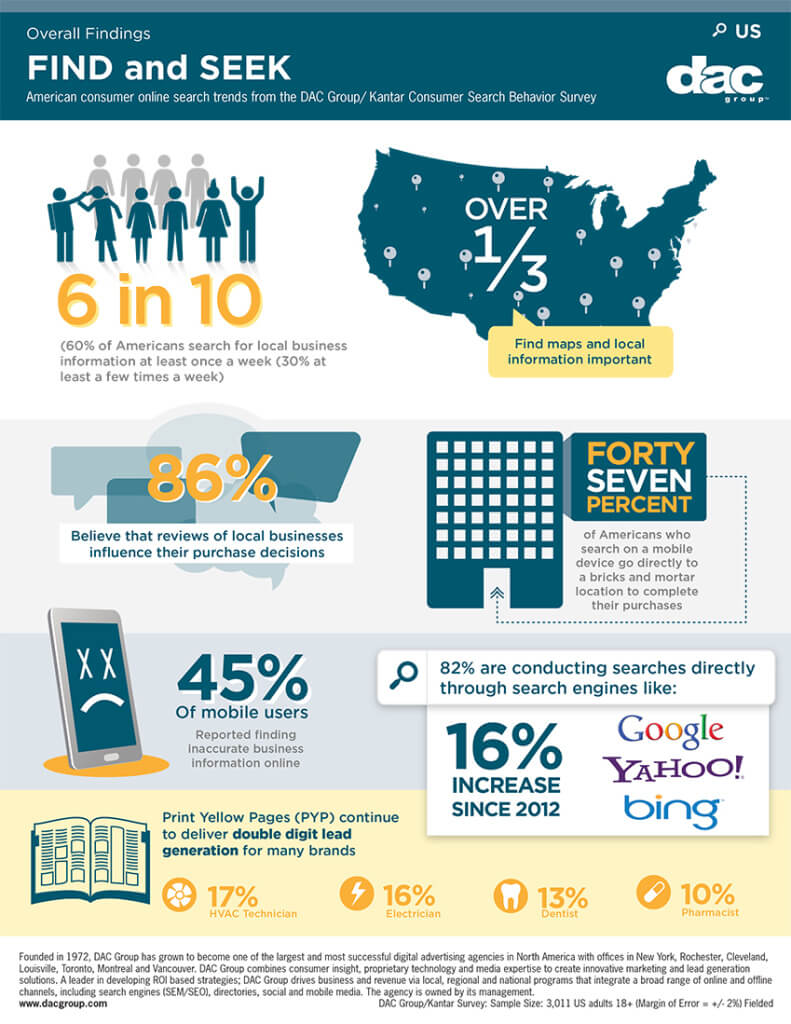

- 60% of Americans search for local business information at least once a week (30% at least a few times a week)

- Over one-third of consumers (82%) find maps/location information important in results

- 86% believe that reviews of local businesses are important in their decision-making process

- 82% are conducting searches directly through search engines like Bing, Yahoo and FireFox or Google; a 16% increase over 2012(opposed to searches within company websites or directory listings)

Mobile

- 92% of consumers searching on mobile devices prefer browser search compatibility over mobile app availability

- 35% of the time, consumers report encountering non-optimised mobile sites

- Clicks to Brick’s relationship remains entwined (47% of consumers searching on mobile devices go directly to a brick and mortar location to complete their purchases)

- Age remains a dominant factor in media use differences among consumers i.e. resources; tools

- 68% agree that seeing a business show up in multiple places increases its perceived credibility

- 45% of mobile users reported finding inaccurate business information online (a YoY increase and area for brand management attention)

- 78% of mobile searches are done on Smartphones

- 84% of Smartphone users find local map inclusion in results somewhat important

Social

- 40% of social media searches (by brand) are driven by deals, promotions and sales. While 37% of mobile social users reported they do not visit brand social media sites at all

- 90% reported that rating and reviews were at least a somewhat important factor to them when making a purchasing decision

- 44% reported they were likely to post about a purchase they have made to their social media network

- 52% of consumers reported contacting customer support as their preferred method for dispute resolution (expressing that 1:1 customer service holds a spot within the purchase cycle)

Key DAC/Kantar Findings (Canada):

- Consumers continue to show greater confidence in “organic search” results over pay for click

- Consumers prefer mobile browsing capabilities over mobile app availability (by a factor of 9)

- 60% of Canadians search for local business information at least once a week (27% at least a few times a week)

- Over one-third of consumers find maps/location information important in results

- 86% believe that reviews of local businesses are important in their decision-making process

- 48% are conducting searches directly through search engines like Bing, Yahoo and FireFox or Google (opposed to searches within company websites or directory listings)

Mobile

- Clicks to Brick’s relationship remains entwined (65% of consumers searching on mobile devices go directly to a brick and mortar location to complete their purchases)

- Age remains a dominant factor in media use differences among consumers i.e. resources; tools

- 63% agree that seeing a business show up in multiple places increases its perceived credibility

- 40% of mobile users reported finding inaccurate business information online (a YoY increase and area for brand management attention)

- 94% of searchers prefer mobile browsers over mobile apps when searching

- 72% of mobile searches are done on Smartphones

- 85% of Smartphone users find local map inclusion in results somewhat important

Social

- 47% of social media searches (by brand) are driven by deals, promotions and sales. While, 34% of mobile social users reported they do not visit brand social media sites at all

- 86% reported that rating and reviews were an important factor to them when making a purchasing decision

- 37% reported they were likely to post about a purchase they have made to their social media network

- 46% of consumers reported contacting customer support as their preferred method for dispute resolution (expressing an interest that 1:1 customer service hold a place within the purchase cycle)

Interested in finding out more? Contact DAC today!