Amplify your reach and drive results with our tailored paid media strategies.

The headline has been months in the making, and we always knew what it would say: the COVID-19 pandemic has driven unprecedented growth in ecommerce as shoppers stay away from physical stores.

But has this rising tide lifted all boats? Did Q2 2020 favor one industry more than any other? Have major retailers doubled down, or have their market shares been eroded by greater exposure to countless online competitors? Let’s take a closer look at some of the more interesting numbers being thrown around.

Earlier this week, Walmart’s Q2 earnings report revealed a staggering 97% growth in US ecommerce sales, including a “triple-digit percentage” rise in sales at its online marketplace. It attributed these gains to more customers shopping online during the pandemic and stocking up on household supplies.

By comparison, Walmart’s US same-store sales also grew, with strong sales in categories linked to the pandemic, such as TVs and connected home devices. Yet this in-store growth is only single digits, reflecting broader trends towards online rather than in-store shopping.

Target’s Q2 earnings report followed the same pattern with even more extreme figures. Its “store comparable” sales grew by a healthy 10.9%, while digital sales grew 195%. That contributed to the retail giant’s revenue mix going from 7.3% digital to 17.2% digital in just one year.

It’s an extraordinary time in ecommerce, with years of change happening in the space of a single quarter. Consumers are predictably spending more online in order to reduce their reliance on in-store visits. When they do visit stores, they’re buying more so that they have to visit less often and, when possible, they’re ordering online before picking up. Welcome to the relatively new world of in-store experience with online transaction—and a textbook case of Enterprise-to-Local marketing.

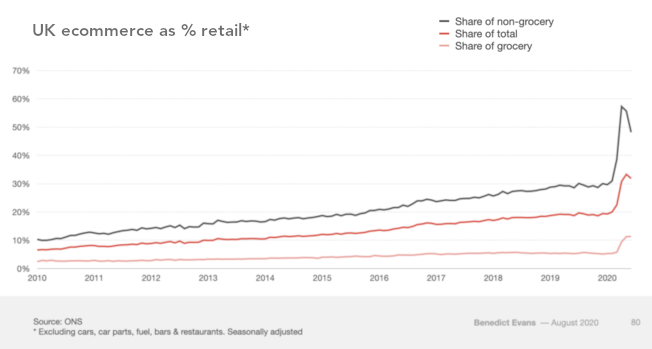

Broad trends tend to ring true. In the US, ecommerce penetration went from 17% to 22% during lockdown. In the UK, it has been an even more impressive leap from 20% to 30%. Notable but not surprising, right? In fact, there are a number of interesting discrepancies beneath the surface.

The pandemic has forced ecommerce to accelerate—and consumers to experiment. Although one might assume that the easing of lockdown measures would see at least a partial return to the familiar old world of in-store shopping, the opposite appears to be happening. In the UK, overall ecommerce sales are surging even as lockdown is eased: ecommerce recently accounted for 60% of all non-grocery UK retail sales. In the grocery sector itself, online grocery sales doubled (though they remain a tiny percentage of overall sales, suggesting serious scope for future growth).

But this prosperity isn’t universal. The industries and businesses most significantly impacted by COVID-19 have been simply unable to make a smooth transition online, including bars, restaurants, and travel providers. But you can also include clothing in that count: clothing store retail sales in the US plummeted from $16bn a month to less than $3bn a month during lockdown—a downturn not nearly made up for by a corresponding rise in online sales.

Subscribe to our monthly newsletter.

So, ecommerce is up and it’s a great time to get into the business, right? Well, not exactly. Although established retailers are thriving online (thanks in no small part to the millions they’ve spent on strategy, tech, and infrastructure), it seems there is little appetite to invest in newcomers and disruptors.

According to CB Insights’ State of Retail Tech H1’20 Report, COVID-19 has decimated retail tech funding from investors, specifically venture capitalists. With many anticipating a wealth of headline-grabbing deals and billions invested, it’s an unexpected footnote in the story of ecommerce’s ascent. But why are investors getting cold feet during an industry-wide boom?

Analysts have floated the idea that Amazon, Walmart, and other retail behemoths have created a “kill zone” in ecommerce. In the shadow of these dominating brands, the grass isn’t as green as it seems because 2020’s record-breaking growth has skewed towards the establishment. In other words, now may not be the best time to gamble on an ecommerce startup: consolidation and iterative change are the watchwords for the foreseeable future.

Is your established brand missing out on the ecommerce boom? Then we have much to discuss. Let’s talk.

Amplify your reach and drive results with our tailored paid media strategies.

Amplify your reach and drive results with our tailored paid media strategies.

Subscribe to our monthly newsletter.