Amplify your reach and drive results with our tailored paid media strategies.

In the age of Netflix and Amazon, YouTube and video on-demand (VOD), you’d be forgiven for thinking that live TV was on its last legs. ‘Death of print’ conversations have shifted to the ‘death of TV’, and there is an abundance of research out there to show that millennials, particularly, are consuming much of their video content online.

But new research by Ipsos Connect and Thinkbox shows the consumer appetite for TV is still very much alive and kicking. In sharp contrast, it finds that advertiser perceptions of TV viewing habits are very much lower, most probably due to their own viewing habits. The danger is that by not stepping outside of their own microcosm, they could be missing a trick, writing off a format which still holds much reach and impact.

The AdNation study questioned 300 advertisers and 800 members of the general public (aka ‘normal’ people) during July and August 2016. Overall it found that advertisers estimate individuals watch 2 hours 41 minutes of television a day, compared to the 3 hours and 35 minutes they actually consume as verified by BARB (Broadcasters Audience Research Board) data. Furthermore, the ad industry significantly underestimates the prevalence of live TV. According to the study, some 87% of TV viewing amongst the general population is of live TV, compared to an industry estimate of just 49%.

The Thinkbox report offers some food for thought, suggesting that ad industry professionals are asserting their privileged position over the entire UK population. While they might be at the forefront of technological change, having the ability to invest in an array of devices and cram in as much media time as possible, not everyone is in the same position. This doesn’t reflect a true cross-section of the UK, the report argues:

“The advertising industry is pretty unique. We’re generally educated, upmarket, London-centric and time-poor and this shows through in our lifestyles, attitudes and behaviour – particularly when it comes to technology and media. Although our industry is based on our ability to understand the rest of the population, we’re surprisingly hopeless at it. Nowhere is this more apparent than when it comes to assessing the media habits of the rest of the UK. It seems we find it difficult not to project our own technological confidence and lack of time onto the rest of the population.”

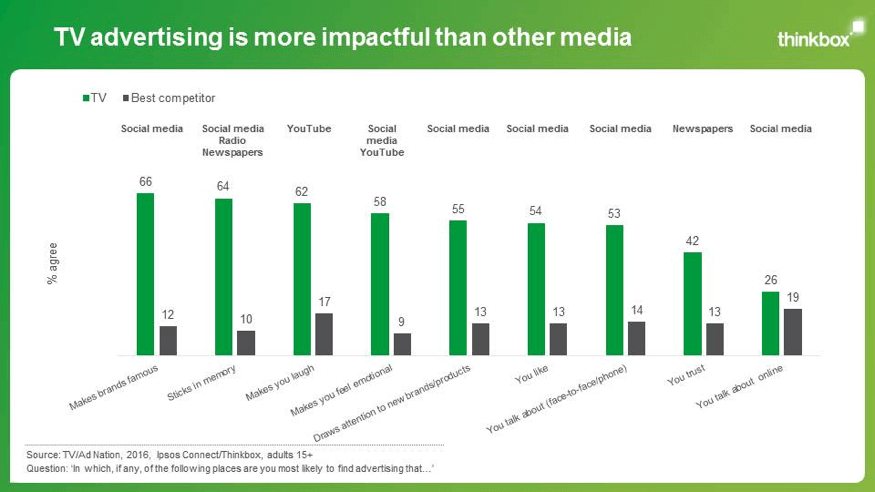

Arguably the most critical finding of the study is that TV advertising continues to have impact; it sticks in our brains and drives brand-fame. The illustration below shows that even when compared with social media such as YouTube, TV can be up to six times more powerful.

Over estimating the importance of online video

Subscribe to our monthly newsletter.

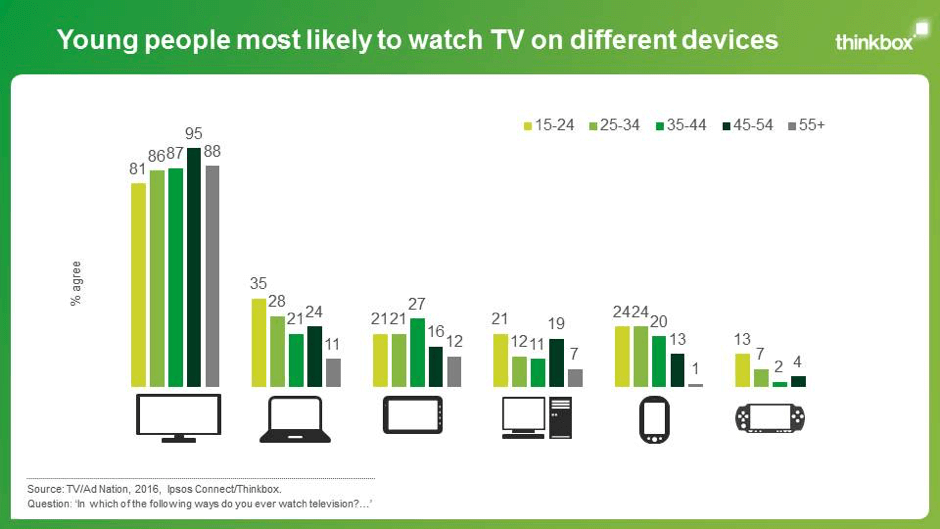

The TV set remains to the most popular way to watch telly, with 92% of respondents saying they view TV in this way. It’s the same for 15-24s, although young people embrace a wider device repertoire. In spite of the abundance of online TV content, over half of the total sample (53%) claimed to only ever watch TV on a TV set, and that figures hasn’t changed since 2014.

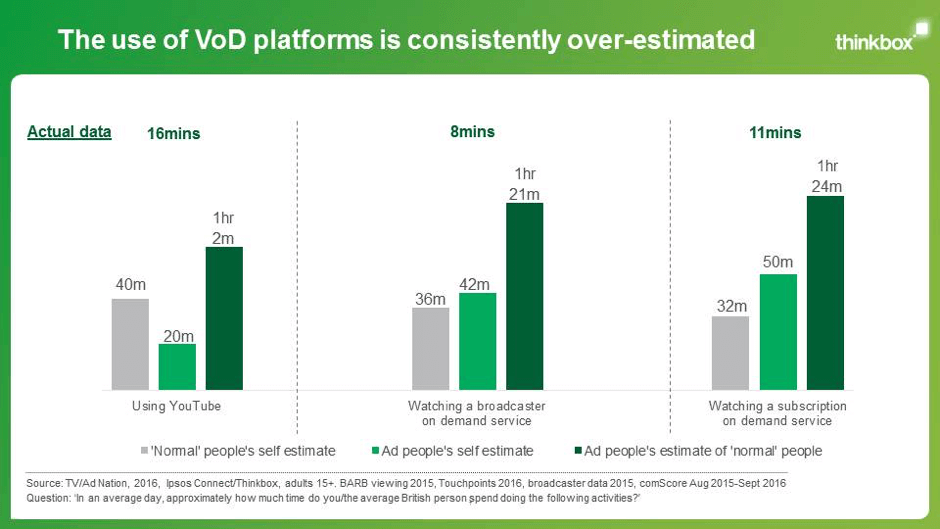

By contrast, advertisers believe on-demand video (VoD) is much more popular than these consumer behaviour figures suggest. They estimate, for example, that the general population watches broadcaster VoD for 1 hour 21 minutes a day, when BARB and broadcaster figures put it at just eight minutes. This trend is echoed in the subscription VoD estimates, where the ad industry feel the UK public watch 1 hour and 24 minutes per day of services such as Netflix, when Touchpoints puts it as just 11 minutes. There is also an expectation among the industry that people spend as much as 1 hour 2 minutes watching YouTube daily, whereas in reality the figure is just 16 minutes.

TV advertising remains important

Despite these continued misperceptions within the ad industry, the one area in which there is agreement between the general public and the ad industry is TV advertising. The research shows that both parties feel TV adverting is the medium we trust the most, the one that is more likely than any other to make us laugh or feel emotional and the one that is most likely to drive brand fame.

These figures go to show the importance of using properly audited, metered data sources that are representative of the UK population as a whole. TV is a long way from being dead. It’s critical the ad industry knows the market, outside of its London-centric demographic, and plans off the back of true audience behaviour, backed by scientific research.

While it’s important to be on top of emerging technologies, trends and behaviours, and future-proof any strategies and investments; focusing on the here and now should be of utmost importance. TV advertising continues to do a good job, and this is likely to remain the case for the foreseeable future.

Amplify your reach and drive results with our tailored paid media strategies.

Amplify your reach and drive results with our tailored paid media strategies.

Subscribe to our monthly newsletter.