COVID-19 shocked the world. Now it’s creating an entirely new world that consumers and businesses must adapt to; a world in which abnormal is the new normal—and it can be overwhelming.

So, how are consumers behaving in these unprecedented circumstances? Have they changed their behaviour in response to this pandemic? Let’s explore the impact this pandemic is having on a global scale.

Are people worried?

Concern about the virus is widespread, with 90% of consumers in the US and UK feeling concerned. However, it’s estimated that 96% of Gen Zs are concerned compared to 90% of baby boomers. Additionally, 60% of Gen Z and millennials are either very or extremely concerned, whereas only 40% of baby boomers share the same sentiment.

Do people trust information about COVID-19, or the media’s depiction of it? According to an Angus Reid Institute poll (accessed through eMarketer), older respondents in Canada are more likely to have indicated that they trust the news media in Canada. Almost two-thirds of Canadians who are 55 and older trust the media, versus fewer than half of individuals between the ages of 18 and 24.

Another study of US and UK consumers found that 40% of people are concerned about inaccurate COVID-19 information. The exception, however, is that there is widespread trust in the reported figures of infection and mortality rates.

Behavioural changes in daily routines

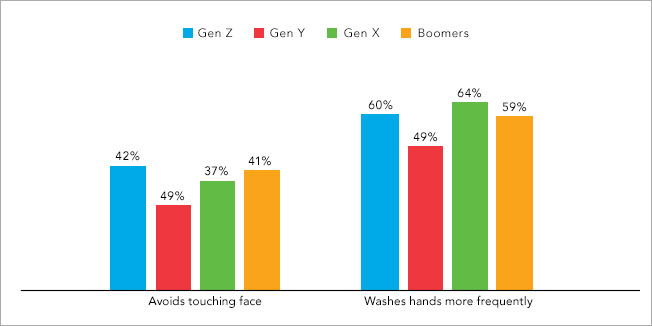

Almost 90% of Gen Z have made changes to their daily routine, compared to just 75% of baby boomers. Additionally, 44% of Gen X that indicated that they read the news more often to stay informed, followed by Gen Z at 40%. A third of Gen Y checks social media more often to keep up-to-date—and there is clearly a real and concerted effort being made when it comes to washing hands more frequently and trying not to touch one’s face.

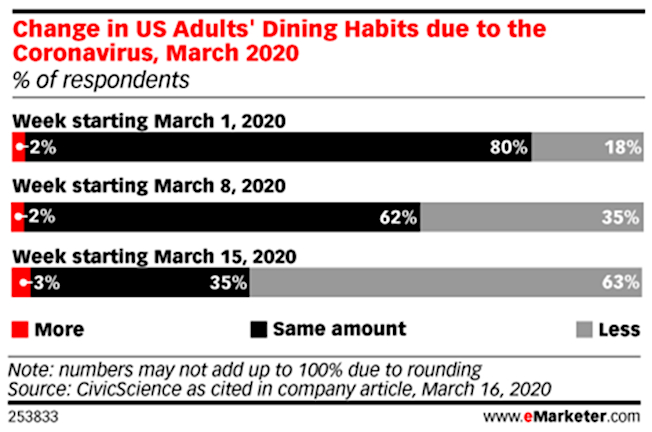

Eating out less

According to eMarketer, 60% of consumers have indicated that they will eat out less due to COVID-19 as of March 15, 2020. Some restaurants have responded by omitting delivery fees to encourage food delivery.

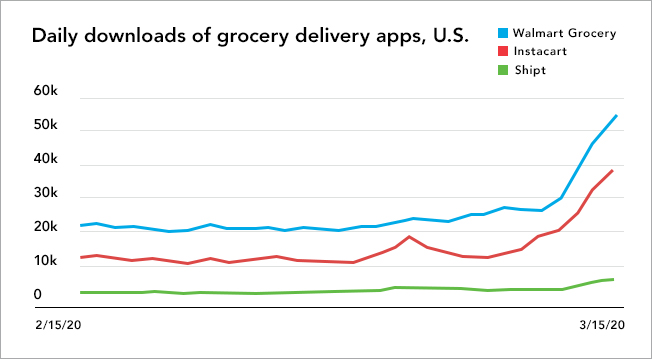

There is also an insatiable appetite for grocery delivery. Grocery delivery platforms such as Instacart, Walmart Grocery, and Grocery Gateway are seeing unprecedented spikes in sales and orders as consumers start purchasing groceries online. Even consumers who have historically never purchased groceries online are finding themselves somewhat forced to shift to online shopping.

Comparing average daily downloads in February to downloads in March, Instacart, Walmart Grocery and Shipt have seen surges of 218%, 160%, and 124% respectively.

Delayed purchases

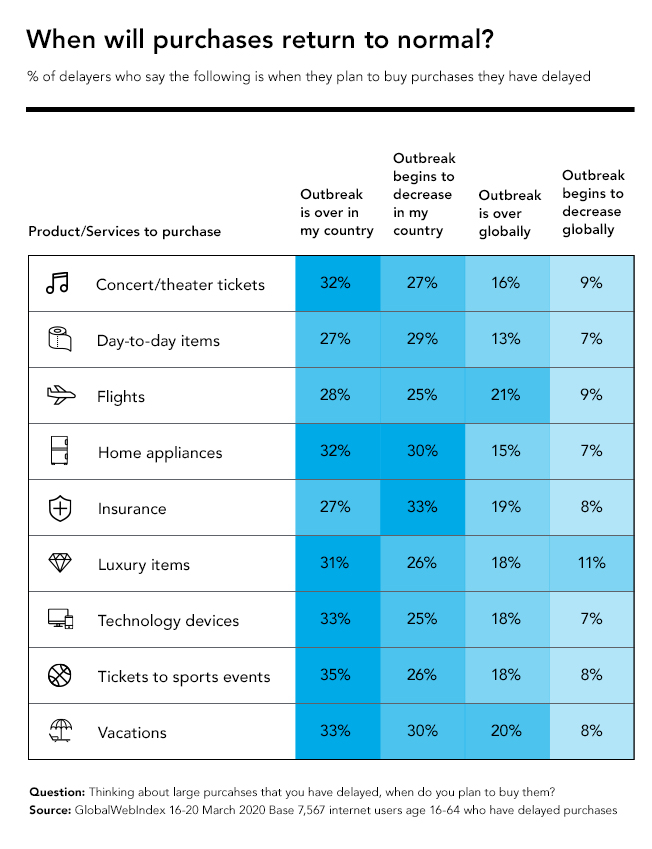

Consumers are more likely to delay purchases, especially expensive and large purchases. More than 40% of consumers have indicated that they will make major purchases only when the outbreak of coronavirus decreases or ends in their country.

All categories face some risk and are being affected one way or another. When it comes to travel, 33% will only buy vacation packages when the outbreak is over in their country. Additionally, the survey found that consumers aren’t only delaying purchases: they are also abandoning their plans altogether. An estimated 22% of global consumers say they have cancelled planned trips to another country, and 35% have cancelled planned domestic trips.

It appears that age is a significant factor when it comes to delaying purchases. Gen Z are most likely to be delaying purchases, and this is true across several categories. This can be attributed in part to lower income levels and uncertainty in general.

In retail, we’re seeing an accelerated shift from store to online purchasing. Coronavirus precautions have led to a decrease in in-store traffic and an increase in online purchasing. Online spending in the US was up 52% year-over-year in a three-week first quarter period. Some researchers are referring to this as a temporary step-change in reaction to the pandemic, while others believe that COVID-19 will forever change the way consumers shop.

Soaring media consumption

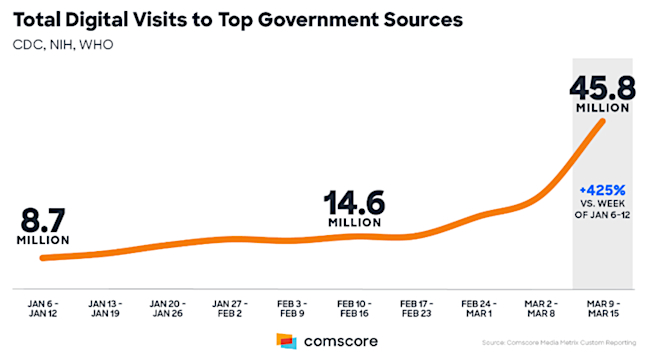

Coronavirus is dramatically impacting media consumption, too. According to a comScore report, total digital visits to CDC, NIH and WHO sites were up 425% (March 9-15 vs. Jan. 6-12), while mobile visits were up 671%. There is an appetite for news from trusted sources as consumers try to stay informed and respond to their new coronavirus realities.

There is also an increase in social media and email engagement in Canada, where there was a 17% increase in daily unique visits to social networks between the week of March 9-15, 2020 and the benchmark week of Dec 30, 2019-Jan 5, 2020.

How should brands respond?

Actions speak louder than words. “Stop with the cute logos; play up your expertise and take action,” said consumer psychologist Kit Yarrow. Sure, changing your logo to emphasise and encourage social distancing is a nice gesture, but it’s just that: a gesture. Brands need to step up their game and show solidarity by taking action. Ask yourself: are you truly living up to your purpose during this crisis?

As reported by The Drum, consumer goods giant Unilever has committed €100m to curtail the spread of coronavirus through the donation of soap, sanitiser, bleach, and food to help protect the lives and livelihoods of consumers, suppliers, and its workforce. In the words of Unilever CEO Alan Jope: “As the world’s biggest soap-making company, we are throwing our weight behind the global effort to protect lives and livelihoods from the COVID-19 pandemic.” Jope also emphasised physical distancing but not emotional distancing. Powerful and empathetic—it’s a great example of a brand living up to its purpose and succeeding where others are falling sadly short.

Other examples include Kiehl’s donating 500,000 meals to Feeding America’s COVID-19 Response Fund, as well as DoorDash partnering with United Way Worldwide to deliver an estimated one million pounds of groceries and meals to households in need.

It’s important to stress that anything self-serving and opportunistic should be avoided at all costs. Don’t make it about yourself, as Yarrow explained. This is not the time to talk about your business and your brand. Instead, seek to understand what consumers need most, and make every effort to continue to add value to people’s lives in meaningful ways that reinforce what your brand stands for.

Be present. Make an impact.

The best thing that you can do as a brand in these tumultuous times is to support your customers in every way you can. Adjust your communications and your strategy accordingly. Avoid being insensitive and emotionally distant. Knowing that 56% of consumers are interested in brands’ COVID-19 initiatives, it is critically important to be present and to contribute to the collective fight of the pandemic.

Responding well to this crisis will help place your business in a strong position today and well into the future. If you need us, we’re here to help you every step of the way.