Google recently announced an enormous change to the Google Shopping tab. In an effort to move more SMBs into an ecommerce-first model, Google has expanded its Shopping platform to include free, organic listings on the Shopping tab of Google.com. There is a lot to unpack here.

For advertisers, the best place to start is to know what is not going to change as a result of this update. For one, Google’s main SERP will still serve Google Shopping ads. The carousel will not show organic listings, and existing feeds will not need to be changed or updated to continue serving your campaigns. To opt in to the free listings feature, you simply need to select the “Surfaces Across Google” setting in your Google Merchant Center.

As for what is changing, the Google Shopping tab of search results will now be populated primarily with free product listings. The change will roll out in the US before the end of April and to more regions across the globe by the end of the year. Shopping ads will serve at the top and bottom of the page, akin to the traditional SERP.

Why is Google offering free ad space?

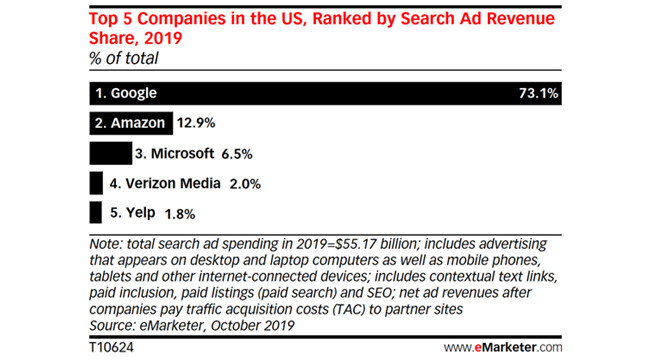

Google has been working on this update for some time now. Its search dominance has been in decline due to Amazon’s rise over the past three years. Searchers are increasingly performing product research on Amazon’s platform, eating into both Google and Microsoft’s search share. Amazon passed Microsoft in 2018 and Microsoft has remained behind in product search traffic since. Google still accounts for more than 70% of all searches in the US, but Amazon’s gains necessitate a change. Google will accomplish a few things with this move.

The first is an influx of structured data and content that will greatly enhance not only Shopping results, but nearly every consumer-facing Google product. The Surfaces Across Google setting on Merchant Center feeds is the key here. As the year continues, we are going to see organic product listings across more Google properties. Products like YouTube, Discover, Image Search (without a doubt), Gmail, and even Maps. It’s easy to envision a time when Google begins to enhance local map pins and knowledge graphs with product suggestions—tailored to fit one’s browsing and buying behavior—that are in-stock and can be purchased with one click. Google can use organic feed data to enhance product recommendations, build out more specific in-market segments, and attempt to stem the tide of search share loss from Amazon, specifically for products to purchase.

The second is a corollary of the first; a shot in the arm for Google Shopping. We don’t expect this change to dramatically impact CPCs across the board, but making the Shopping tab more useful to users and giving Google more flexibility on where product listings and information serve could result in more volume and a change in user behavior. That means there will be both better targeted ads and more ad clicks to go around. Users already know how to search and scroll marketplaces—and Google just created a marketplace of the entire internet.

When Google decided to sunset the right-hand rail ads, there was much hand-wringing around the loss of control, the inventory scarcity, the inevitable rise in CPCs while advertisers fought for top spots. While there was some disruption, it was nowhere near as impactful as advertisers feared. The ad inventory that is being removed in favor of organic listings on the Shopping tab is reminiscent of when positions 8-11 were removed from the SERP back in 2016. Likely, these weren’t huge volume drivers for any given business. Due to that fact, overall impressions in campaigns may fall, but one would expect clicks to remain somewhat steady and CTR to increase in line. We saw similar trends following the right-hand rail update.

What should advertisers do now?

If your Shopping campaigns are properly optimized, your feed is maintained, and your inventory is stocked, this will likely not result in a shock to your campaigns. As noted above, there may be a drop in total impressions as low-positioned ads from the Shopping tab are replaced with new, free listings. That being said, there are some areas that will require key decisions to be made in the coming days.

-

Campaign structure

Traditional Shopping ads setups use priority and product group bids to allow the full feed to serve against relevant queries. Because SKU-level bids require a high volume of specific and high-intent searches, granular campaign structures with individual bids have always been interesting in theory—but difficult in practice. Now that a merchant’s full catalog of products can be found online, shopping feeds can focus on high-margin, high-volume products that may support a more granular structure. This could further increase shopping ROI in the same way standard paid search focuses on high-converting keywords and audiences. Fewer SKUs in paid campaigns is actually one way paid campaigns can be “augmented with free listings”, as Google’s Bill Ready, President of Commerce, noted in his announcement.

-

Copy optimization

Organic Shopping listings, and how they perform, are going to be new for every advertiser—especially as Google works on pushing these listings across all Google Surfaces. This will require copy testing and optimization that differs from what has been done in the past. Testing new copy variants in Paid Shopping listings will give quick feedback on what products are converting, but as Organic Shopping listings proliferate across Google, they may do better with a more mid-funnel, content-centric approach.

We would caution all advertisers to resist the urge to make Organic and Paid Shopping listings look identical. There will be insights to take away from Paid Shopping, but we should all think of Organic Shopping as a slightly different channel.

-

Learn and test

The syntax here is the important part. The addition of listings in Google Shopping will result in a significant change, and will certainly not be the last change we will see to the program. Traffic patterns and user behavior over the coming months will change daily. As parts of the world begin to reopen from the COVID-19 pandemic, the way shoppers interact with Google’s listings will change. The instinct for all good performance marketers is to test anything new, but both Google itself and the world at large are going to be actively changing and reacting to the pace of consumers and the pace of business a multitude of times before 2020 comes to a close. Find ways to be opportunistic, but be careful not to take the early performance as a firm truth. Learn, then test and repeat.

As the world turns, so too does digital advertising. But with the right strategy and the right media mix, you can keep your brand on the front foot. We’ll help you get there. Let’s talk.